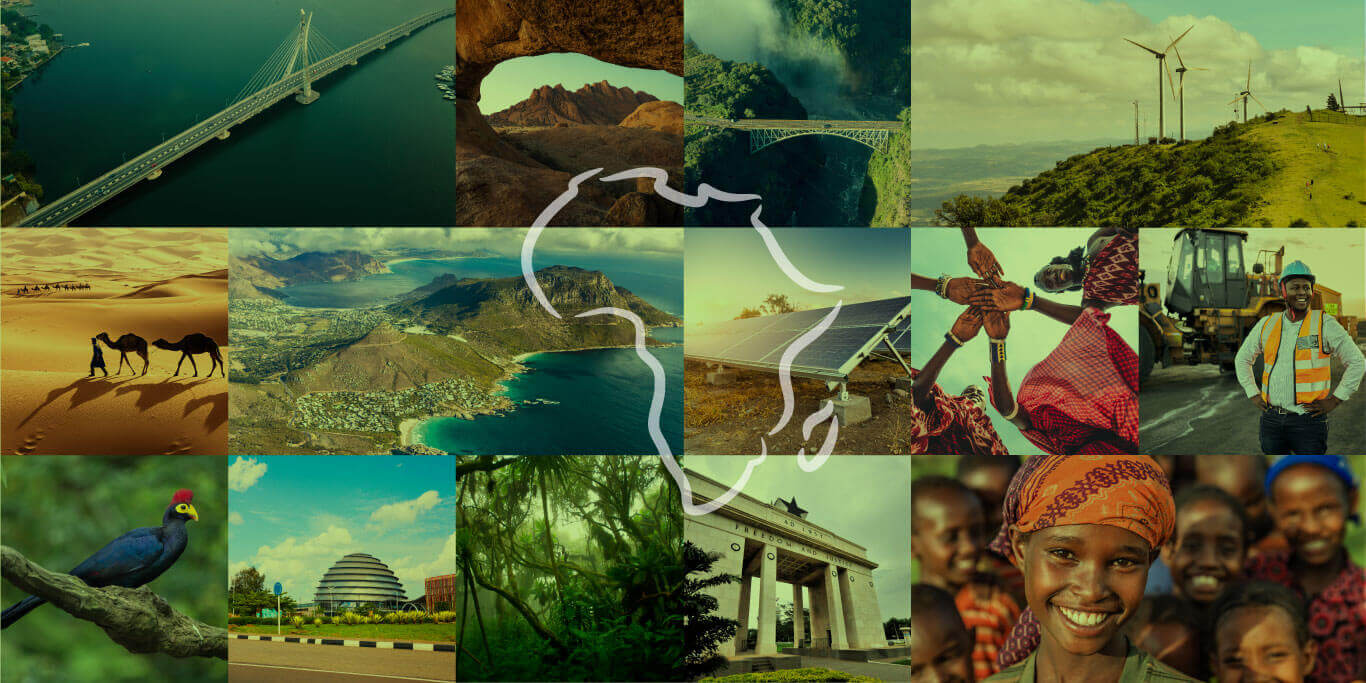

Driving Sustainability in Insurance

Collaborating to create a roadmap for sustainable insurance

Our Objectives

Build awareness and support for Sustainable Insurance Principles

Contribute to advancing sustainable practices in the insurance industry.

Integrate Sustainable Insurance into core business

Help us educate and spread awareness about the role of sustainable insurance in achieving the UN SDGs.

Foster Collaborative Networks

Enable partnerships and collaborations across Africa that empower insurers to drive positive environmental and social impact.

Driving impact through sustainable insurance

Together, we’re building a resilient tomorrow through collaborative action. The NDSI Declaration empowers insurers to integrate sustainability into their operations, driving positive change for businesses, communities, and ecosystems.

Join the movement for sustainable insurance

The NDSI Declaration empowers insurers to integrate sustainability into their operations, driving positive change for businesses, communities, and ecosystems.

A growing coalition for change

Policyholders Impacted

A growing coalition for change

A Growing Network of Sustainability Leaders Across Africa

Discover the impact of the Nairobi Declaration on Sustainable Insurance. Our growing network spans multiple countries, driving sustainability and resilience to reshape the insurance landscape for communities and the planet.

Members Stories

Driving change together

Joining NDSI has empowered us to align our business strategy with global sustainability goals.

Dr. Patrick Gatonga, Group CEO, AAR Insurance

Through collaboration with NDSI, we’ve built partnerships that enable us to drive financial inclusion and sustainability at the core of our operations.

Hope Murera, CEO, ZEP-RE

As a signatory, we are redefining insurance not only to protect assets but also to nurture the environment we live in.

Sammy Muthui, CEO, Minet Kenya

Join NDSI

Transform insurance, empower communities

Join industry leaders committed to sustainability. Align with ESG principles, access resources, and collaborate on solutions to achieve the UN SDGs. Together, we build resilient businesses and stronger communities.

Membership Benefits

Collaborate and Lead

Join forces with industry pioneers committed to ESG principles and the UN SDGs.

Access Resources and Insights

Get exclusive access to research, reports, and sustainable insurance frameworks.

Learning and development

Shape the future of sustainable insurance through working groups and partnerships.

Influence Policy

Shape the future of sustainable insurance through working groups and partnerships.

Boost Your Brand

Position your organization as a leader in sustainability and social responsibility.

Latest News & Insights

Role of Insurance in Strengthening Africa’s Social and Economic Resilience

Insurance is a safety net and a resilience-building mechanism. As...

Read MoreTop 6 ESG Reporting Practices for Driving Sustainable Insurance in Africa

Resilient insurance providers in Africa rely on transparency and accountability...

Read MoreDriving SDG Impact Through Insurance in Africa

With the shifting global climate, insurance is no longer just...

Read MoreEvent schedule

No upcoming events found.

Resources

Driving Sustainable Futures Through Practical Tools and Insights

Press Release – African insurers reach new sustainability milestone with US$52 billion of investments now linked to climate action and social inclusion

DownloadNDSI invites insurers, policymakers, and organisations across Africa to join this transformative initiative.

Together, we can shape a sustainable future by managing today’s risks and creating opportunities for tomorrow.